Ad valorem tax calculator

Ad Valorem Tax For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

Car Tax By State Usa Manual Car Sales Tax Calculator

However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer.

. The Minerals Tax unit of the Special Taxes Division provides counties with valuation information only for the ad valorem taxes on unmined taconite and unmined natural. The most common ad valorem taxes are property taxes levied on. For another example lets say the property taxes on a home come.

Dallas County Property Tax Calculator This calculator uses 2021 rates derived from the Dallas County Appraisal District DCAD website on November 3 2021 and reflects the passage of. The ad valorem calculator can estimate the tax due when purchasing a vehicle of any sort. The millage rate also known as the tax rate is a figure applied to the value of your property to calculate your property tax liability.

Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Ad Valorem taxes are calculated based on the vehicles assessed value. The Tax Division of the Arkansas Public Service Commission determines Ad Valorem Assessments for property tax purposes on public utilities and carriers including.

The Latin term ad-valorem translates to English as according to value These taxes can be. An ad-valorem tax is a tax that is levied on the assessed value of real or personal property. The assessed value of property is generally 60 percent of its fair market value or 60 percent of its value determined under the valuation methodology specified.

Ad valorem tax is a property tax not a use tax and follows the property from owner to owner. If the sale included a trade-in the FMV is first reduced by that. Ad Valorem Property Tax.

The most common ad valorem taxes are property taxes levied on. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value. Generally the TAVT is calculated by multiplying the applicable rate times the Fair Market Value FMV as defined by law.

One mill equals one dollar of tax on every thousand. Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the. The Department of Revenue has set up an online Title Ad Valorem Tax Calculator that you can use to estimate of the new Title Ad Valorem Tax that will apply to all vehicles.

This is determined by multiplying the market value times the corresponding Property Classification.

Tax Rates Gordon County Government

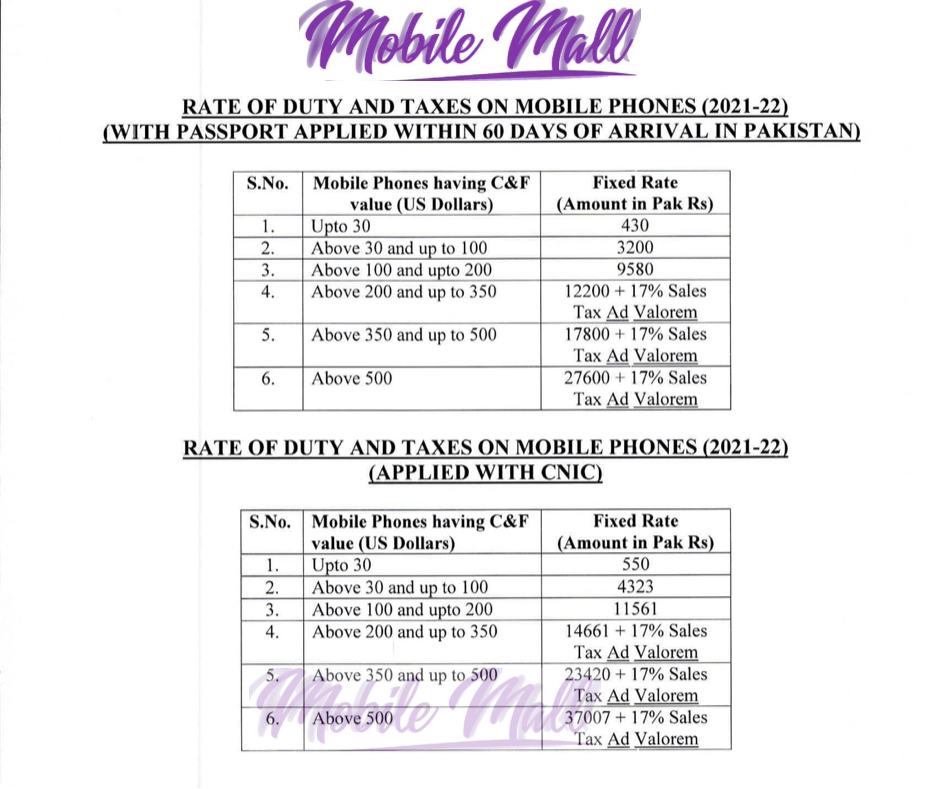

Pta Tax List 2022 Pta Tax Calculator On Mobile Registration

Car Tax By State Usa Manual Car Sales Tax Calculator

Property Tax Calculator

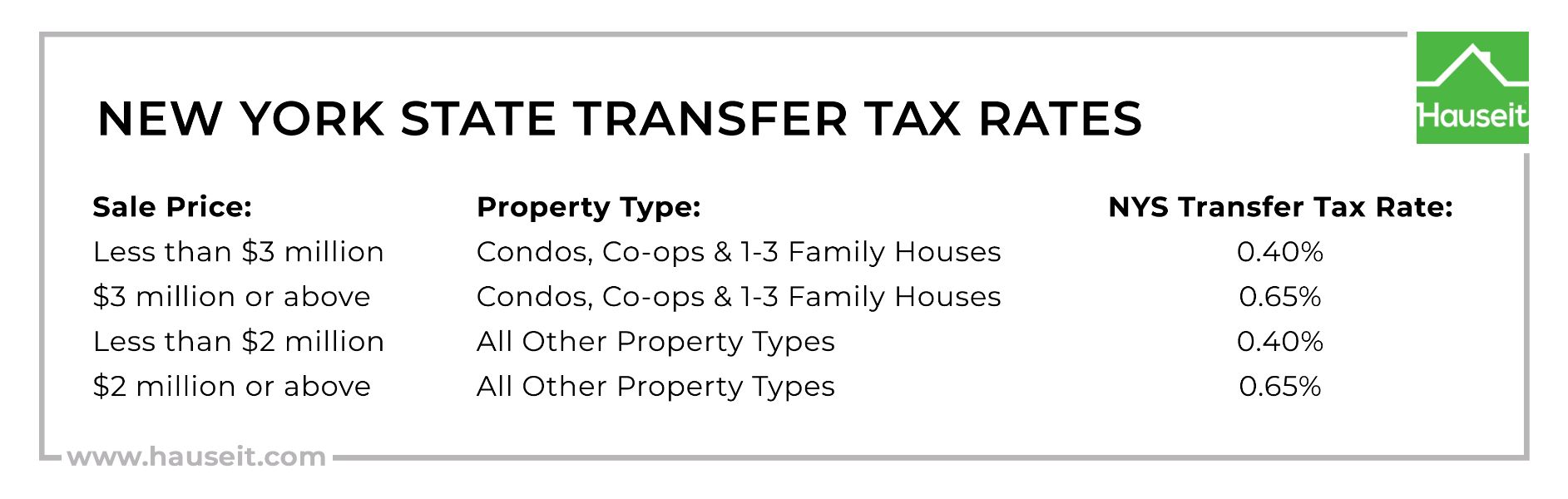

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

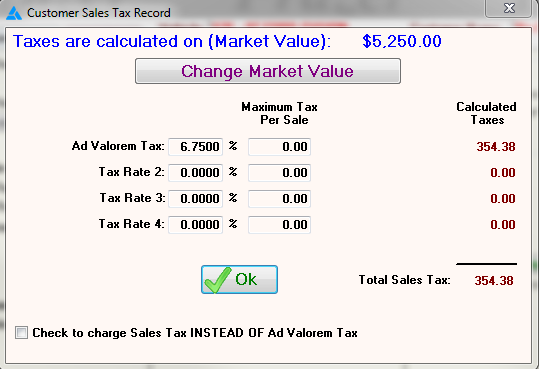

Frazer Software For The Used Car Dealer State Specific Information Georgia

Dmv Fees By State Usa Manual Car Registration Calculator

Property Tax Calculator How Property Tax Works Nerdwallet

Property Tax Chennai Online Calculator And Payment Guide

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Tax On Rental Income Calculator Outlet 54 Off Www Ingeniovirtual Com

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Tax Rates Gordon County Government

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Texas Property Tax Calculator Smartasset

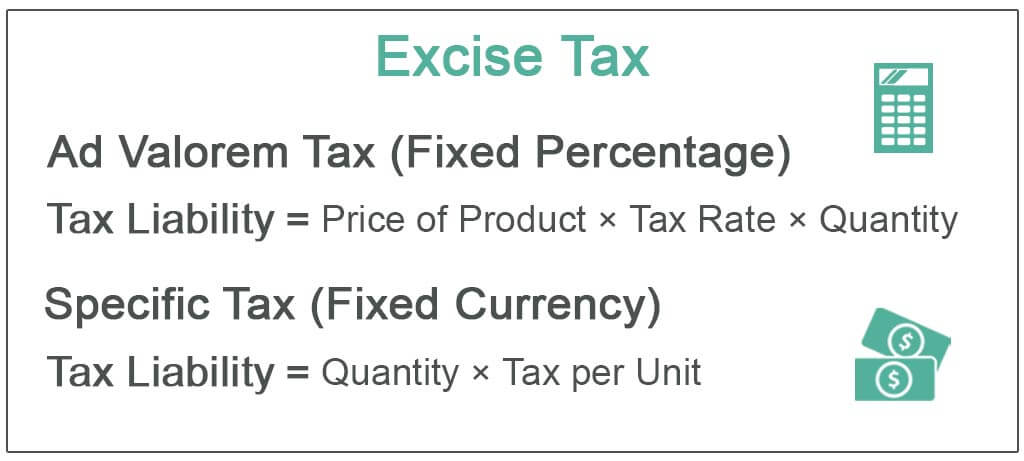

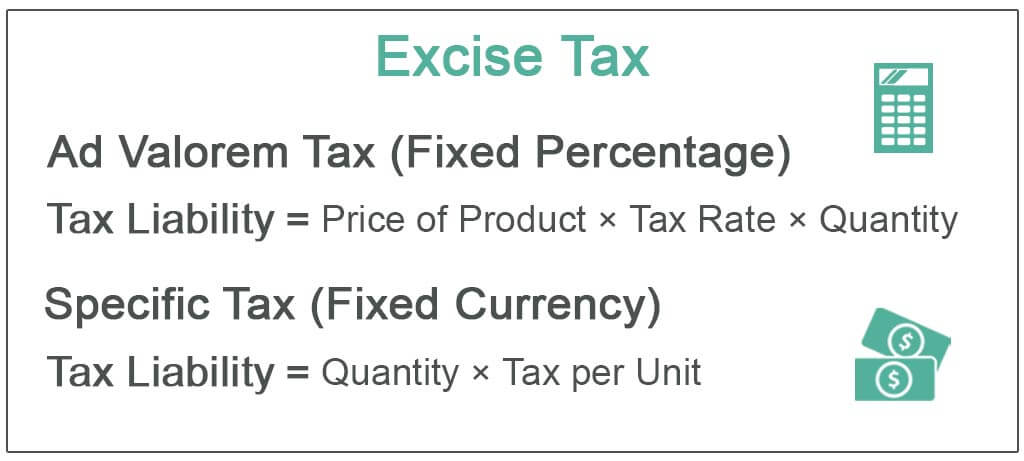

Excise Tax Definition Types Calculation Examples